Personal Finance 101: The Cash Flow Statement

Take a breath.

Don’t stress out if you read the title of this article and have no idea what a cash flow statement is.

I am 41 years old and just learned about it recently, so it’s new to me too.

And, the only reason I know what it is and why it is important is because I have been taking a financial planning course for the past 10 months. I learned it there.

So, if you’re feeling behind, don’t worry, we’ll get you caught up!

What is a Cash Flow Statement?

Here is the technical version: A cash flow statement is a detailed description of your cash inflows and outflows over a specified period.

In layman’s terms: A cash flow statement captures money that is flowing into and out of your bank account each month (if you track it monthly).

Cash Inflows: Cash coming into your bank account (income).

Includes:

- salary

- income

- commissions

- pensions

- disability

- interest and dividends from investments

- and other sources of income

Cash Outflows: Cash going out of your bank account (expenses).

Includes:

- groceries

- mortgage

- rent payments

- utility bills

- interest

- car expenses

- contributions toward savings

- and any other expenses

How Do You Calculate Your Net Cash Flow?

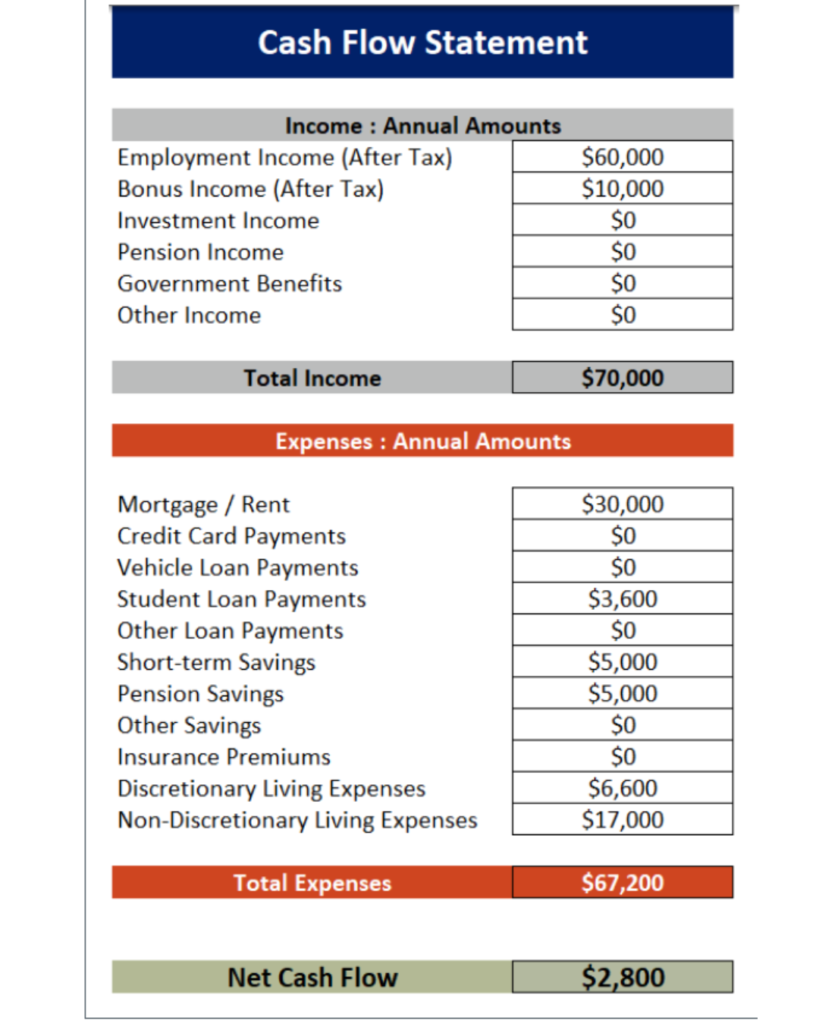

You can calculate your net cash flow using this simple equation:

Cash Inflows – Cash Outflows = Net Cash Flow

Here is an example of a Cash Flow Statement (not mine!):

The Purpose of A Cash Flow Statement And Why I Calculate Mine Monthly

Preparing a cash flow statement can help you understand your patterns of spending and saving, as well as identify potential opportunities to adjust income to help meet your financial goals.

I have been calculating my cash flow statement monthly since October 2023, and what I have learned is that my outflows are more than my inflows month after month. Which means that I spend more than I make. This is called a cash flow deficit.

Unfortunately, this continues to be an issue in my financial health. I simply do not earn enough money to keep up with expenses.

Without calculating my net cash flow monthly, I would not know how big the gap is between my cash inflows and outflows.

You don’t know what you don’t track.

I could continue living in a denial bubble, but what good would that do?

I have hidden from my finances long enough, and by keeping regular tabs on them, I can make a realistic plan to rectify the situation.

How Can I Turn My Cash Deficit Into A Cash Surplus?

There are a couple of things I can do to help improve my cash flow, including:

- Decrease my expenses

- Increase my income

Budgeting helps keep my expenses in check, and I try my best to spend the least amount of money as possible, so decreasing my expenses won’t do too much to improve my cash flow at this point.

However, I need to increase my income. I currently work at my own small business and keep part-time hours so that I am around for my kids.

But, I am now finishing my school to become a financial planner, and I am looking for full-time work.

I have enjoyed being a stay-at-home mom for the past 10 years, but due to changing personal situations, that option is no longer possible.

Coming to that conclusion is not easy, but the budget doesn’t lie, and neither does my net worth statement.

Sometimes we need to make tough decisions to ultimately improve our lives, and this is what I am doing.

So, whip out your budget, figure out your cash inflows and outflows and calculate that net cash flow.

You may not like what you see, but better than living in a far-off place – denial.

You can do it. I know you can.

Written by Kathy

More From This Category

Is It Worth Getting a Lawyer When Separating From an Uncooperative Common-Law Spouse?

Is It Worth Getting a Lawyer When Separating From an Uncooperative Common-Law Spouse?Disclaimer: This is a rather specific topic that applies to my life now. I want to preface this article by saying that this is MY OPINION based on my experience. Every separation is...

As A Man Thinketh By James Allen Book Review

As A Man Thinketh By James Allen Book ReviewAs A Man Thinketh By James Allen is a self-help book that was originally published in 1903. As the title might allude to, it’s not exactly politically correct for today’s day in age, but the messages are clear. When I read...

Navigating Single Motherhood: My Ongoing Journey to Financial Independence and Personal Growth

Navigating Single Motherhood: My Ongoing Journey to Financial Independence and Personal GrowthHi, I’m Kathy. I thought by this age that I would be living the life of my dreams. Instead, I feel more behind than ever. I am a 41-year-old single mom who lives with my...

0 Comments