Why You Should Calculate Your Net Worth

I calculate my net worth every month, and you should too.

My goal is to increase my net worth and you don’t know what you don’t track, so I suck it up every month and calculate my net worth to make sure it is going in the right direction (up!).

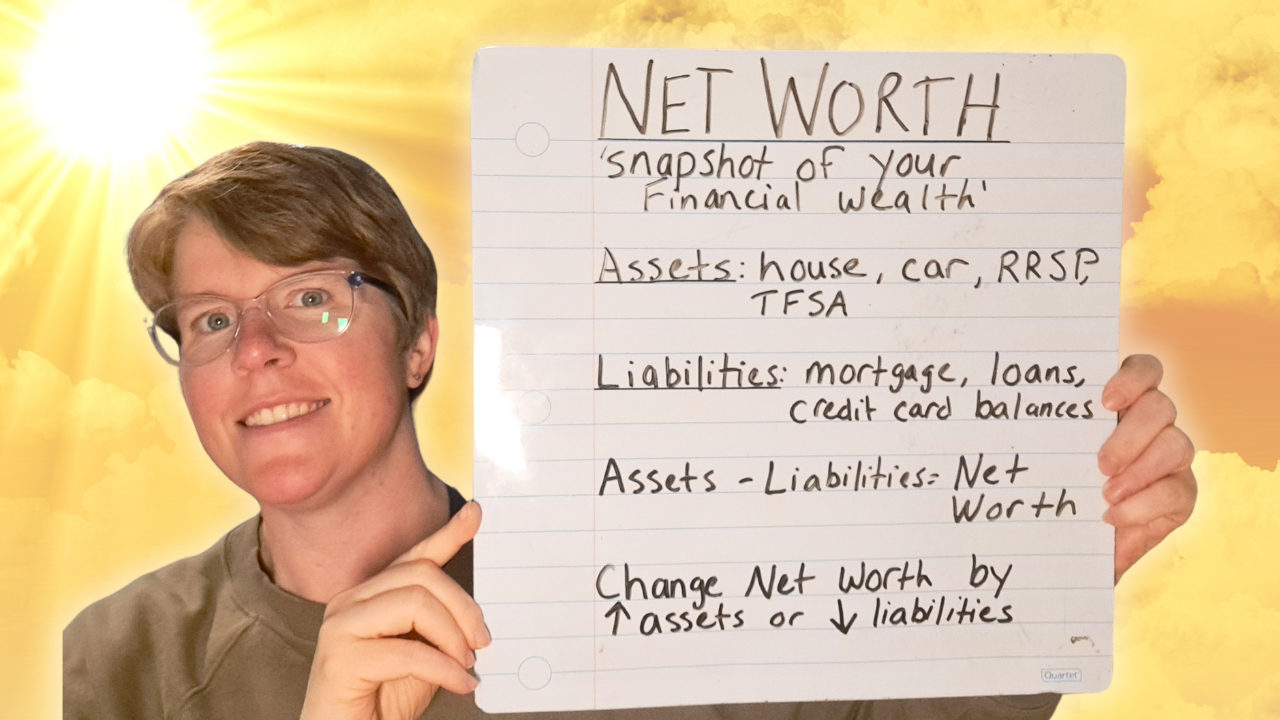

What is A Net Worth Statement?

A net worth statement is a snapshot of your financial wealth. It summarizes how much you own (your assets) and how much you owe (your liabilities).

It is a starting point for establishing and achieving personal financial goals

What Is An Asset?

An asset is what you own.

Examples include:

- House

- Car

- RRSP

- TFSA

- Registered Pension Plans

- Non-Registered Investment Accounts

- Cash in Chequing and/or savings accounts

What Is A Liability?

A liability is what you owe.

Examples include:

- Mortgage

- Personal loans

- Car loans

- Student loans

- Credit card balances

- Line of credit

How To Calculate Net Worth

Luckily, it’s a simple equation:

Assets – Liabilities = Net Worth

If after you have calculated your net worth you don’t like what you see, there are 2 ways to increase your net worth, they are:

⇒Increase your assets, or

⇒Decrease your liabilities

Or to increase your net worth faster, do both. Increase your assets AND decrease your expenses.

You can increase your assets by making more money. I know it’s not fun to hear that you don’t make enough money.

I don’t.

I know that I am going to have to increase my income. I can do this by either getting a second job or finding a higher paying job.

I am almost done with school, so I am hoping to find a higher paying job than my current one. I also know that if I end up working part-time, I will keep doing my current job part-time and hopefully earn more money.

To decrease your liabilities, try to pay off debt.

I am prioritizing paying off my credit card so I have fewer liabilities.

Increasing your net worth is not easy. It takes time and discipline. I often struggle with discipline and mess up from time to time. The important thing is that I don’t allow my mess-ups to totally derail my progress. I make a mistake, take some time to think about why I did it, then move on and try not to make the same mistake again.

We are human. Expecting perfection is unrealistic.

Take the first step and calculate your net worth. Get an idea of where you stand financially so that you can make a plan to improve.

It doesn’t take long and most of the figures you will need are on your bank statement or in your budget.

You just have to do it. Take that step.

We are in this together!

Written by Kathy

More From This Category

Is It Worth Getting a Lawyer When Separating From an Uncooperative Common-Law Spouse?

Is It Worth Getting a Lawyer When Separating From an Uncooperative Common-Law Spouse?Disclaimer: This is a rather specific topic that applies to my life now. I want to preface this article by saying that this is MY OPINION based on my experience. Every separation is...

As A Man Thinketh By James Allen Book Review

As A Man Thinketh By James Allen Book ReviewAs A Man Thinketh By James Allen is a self-help book that was originally published in 1903. As the title might allude to, it’s not exactly politically correct for today’s day in age, but the messages are clear. When I read...

Navigating Single Motherhood: My Ongoing Journey to Financial Independence and Personal Growth

Navigating Single Motherhood: My Ongoing Journey to Financial Independence and Personal GrowthHi, I’m Kathy. I thought by this age that I would be living the life of my dreams. Instead, I feel more behind than ever. I am a 41-year-old single mom who lives with my...

0 Comments